Improving your Credit: What to Know About 0% APR Intro Rate Cards

Tips for navigating 0% APR intro rate credit cards.

Using a credit card with an introductory 0% APR can be a great way to save on interest when making a large purchase or reduce credit card debt with a balance transfer. Before you apply for one of those cards, here are some things you should consider.

Introductory Rate is Real

As the name suggests, that 0% APR offer is only for an “introductory” period. Make sure you note when your intro offer ends so that you have a roadmap for paying off your balance completely by then.

Balance Transfers May Be Helpful

Transferring a balance from a high-rate card to a 0% APR card can be a smart financial move if you pay off the balance. When transferring a balance, remember that there is a deadline for requesting and completing it. Some cards offer 60 days to request and complete the transfer, some less. Keep in mind that it can sometimes take up to 21 days for a transfer to be completed.

Transfer Fees. Remember that there could be a balance transfer fee. Typical fees range from three to five percent of the amount you want to transfer.

The Intro Period Will End

Once the intro period ends, any balance you have on that card will begin to receive interest charges. That interest charge can sometimes be quite high. Make sure you have a plan to pay off your balance in full before that intro period ends.

Carefully read the terms of your 0% intro credit card before signing up. Make sure you have an attainable plan to pay off the card before that intro ends.

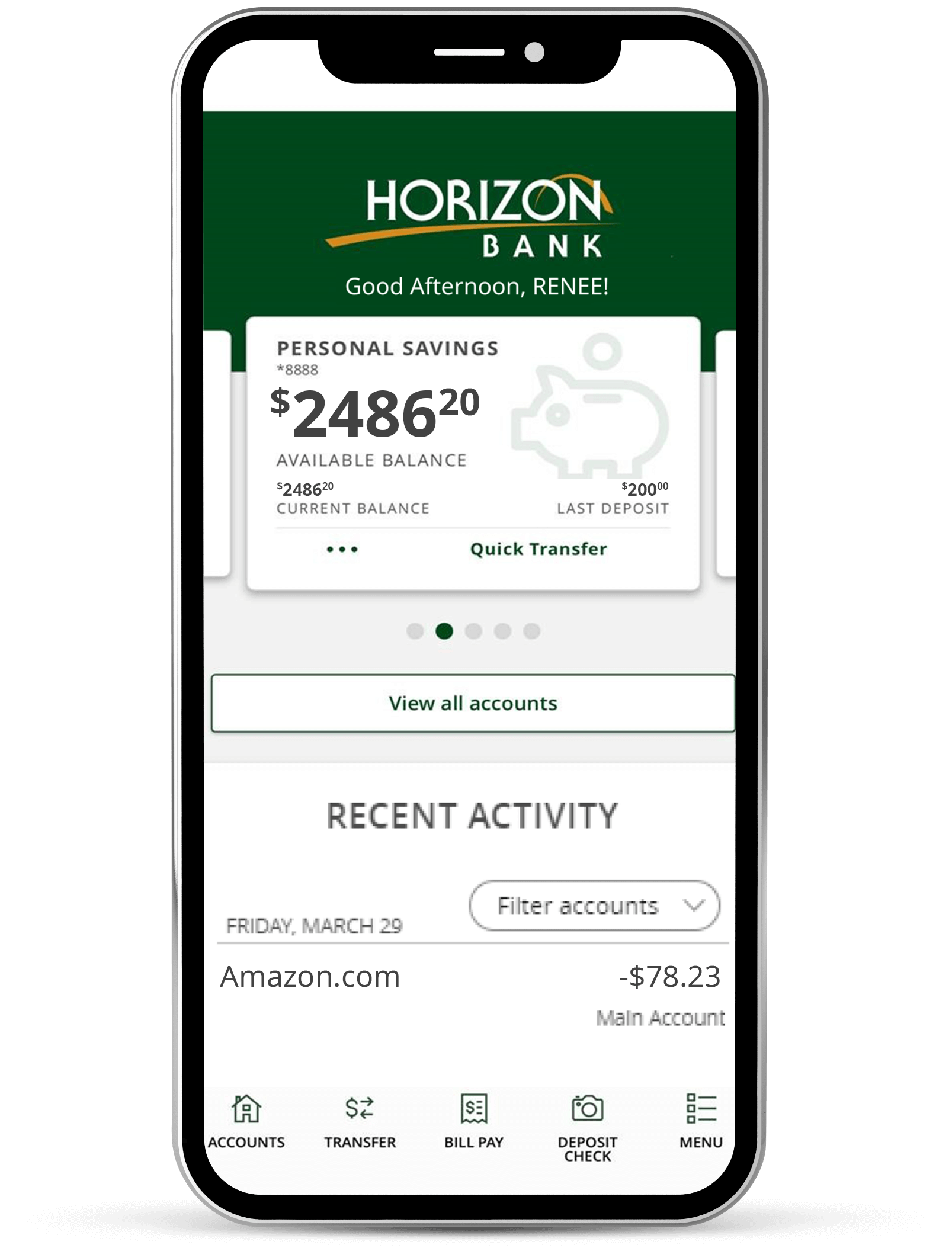

Horizon makes it easy to monitor on your credit score with CreditAdvisor in Online Banking. Get your daily score for free – enroll now!