4 Reasons You Need to Start Using Zelle®

Chances are high that you have a peer-to-peer (P2P) payment app on your phone. P2P apps are digital platforms that let you send and receive money from others. They’re commonly used for paying rent, purchasing items at markets, or repaying family and friends for meals and trips. The apps work by storing money you’re sent in their third-party system before depositing it in your checking or savings account at your bank.

While popular P2P payment apps like Venmo, PayPal, and CashApp have their merits, Zelle® stands out with its unique features and enhanced security. Zelle® allows you to send, request, and split payments with family and friends using their email or phone number, just like other apps. However, Zelle® offers more perks and a higher level of security, making it a superior choice. Here are four compelling reasons to switch to Zelle®.

You Get Better Bank Integration

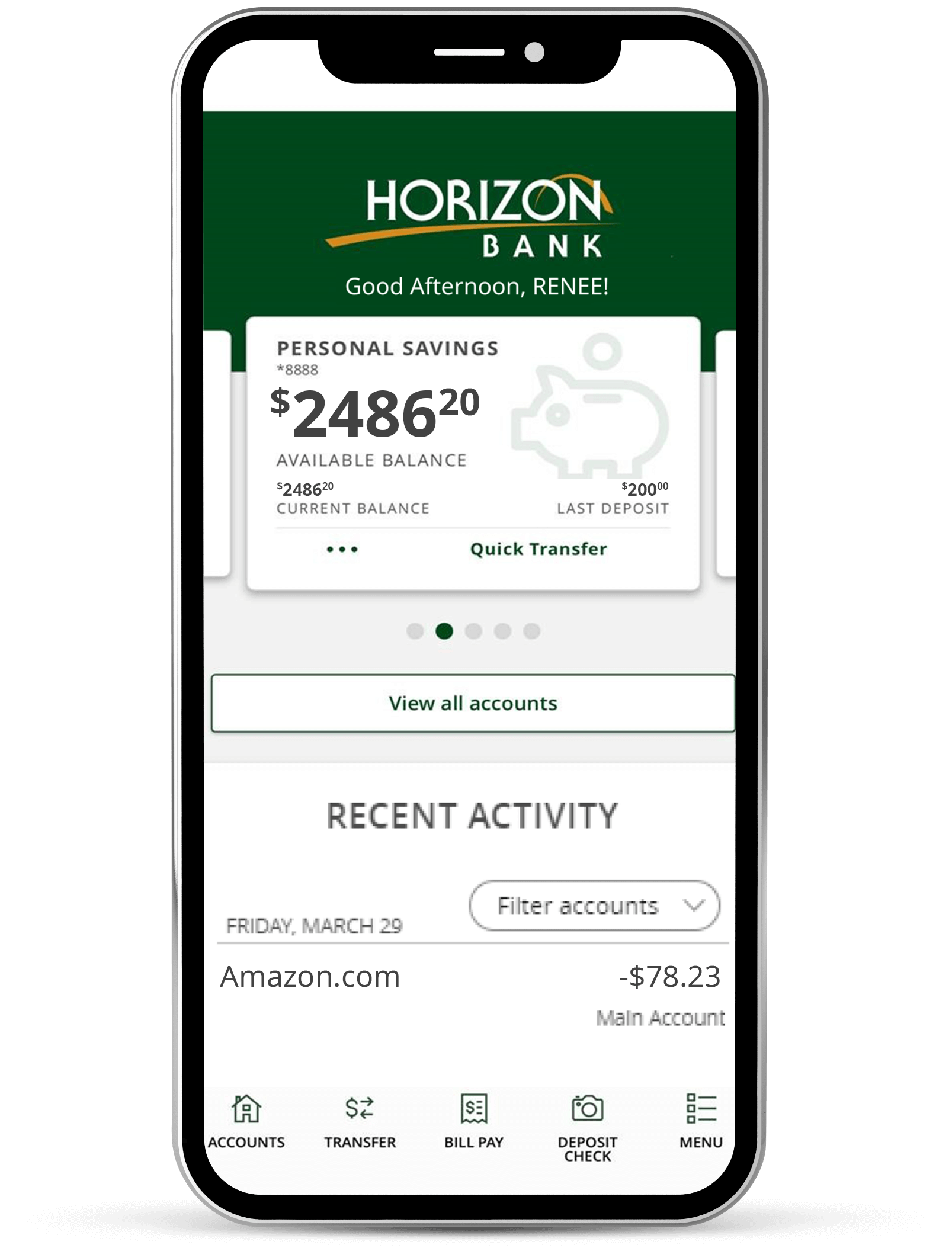

One of the standout features of Zelle® is its seamless integration with your bank account, making transactions a breeze. If you're a Horizon Bank customer, you can use Zelle® directly through your mobile banking app, eliminating the need to download another app. This convenience is a significant advantage over other P2P payment apps.

You Avoid Fees and Save More Money

Some P2P apps charge 3% on instant deposits, and others have annual fees for using the app. Zelle® doesn’t! As a Horizon Bank customer, you can easily use Zelle® through your online banking without paying extra fees.

You Get Your Money Right Away

Unlike most P2P payment apps that hold your money for 1-3 days before depositing it into your bank account (unless you pay a 3% charge for an instant deposit), Zelle® offers immediate access to your funds. Thanks to its direct integration with your bank, you can expect to receive your money within minutes of the transaction, a significant advantage that sets Zelle® apart.

Your Money and Exchanges Have Bank-level Security

Most P2P payment apps don’t have FDIC insurance. Because P2P apps are not banking apps, they don’t qualify for federal protections. Fortunately, Zelle® has FDIC protection and bank-level security! Unlike other P2P apps, money sent with Zelle® never sits in a third-party location, so it is protected and insured by the bank it is sent from and the bank it goes to.

At Horizon Bank we prioritize our customers’ financial safety and security. Zelle® makes P2P payments safer and more secure than other apps. The best part is that you can start using Zelle® today—without downloading another app—when you use your mobile banking app. Contact us to learn more about Zelle® and other banking tools that can help you on your financial journey!