How Often Should I Pull My Credit Report?

Truth be told, not everyone wants to take a walk down memory lane if their financial history has been a bit, shall we say, bumpy. Research spanning a decade shows that millions of Americans never take a look at their credit file. But here’s the thing: You can’t fix what you don’t know about.

With billions of pieces of information floating through the ether between companies and the three major credit reporting agencies, mistakes are bound to happen. And they do. This is one of the many reasons you should request a copy of your credit report annually — even if you pay your bills on time and have a solid credit history.

Request a Report Often

That means if it has been a while (or never) since you requested a copy of your credit report, now’s the time to get up your gumption and do it. The Consumer Financial Protection Bureau (CFPB) also suggests people pull a report at least every 12 months, to make sure there are no errors that could result in someone not getting the best terms on a loan, or worse, being rejected altogether.

It’s Free and Easy

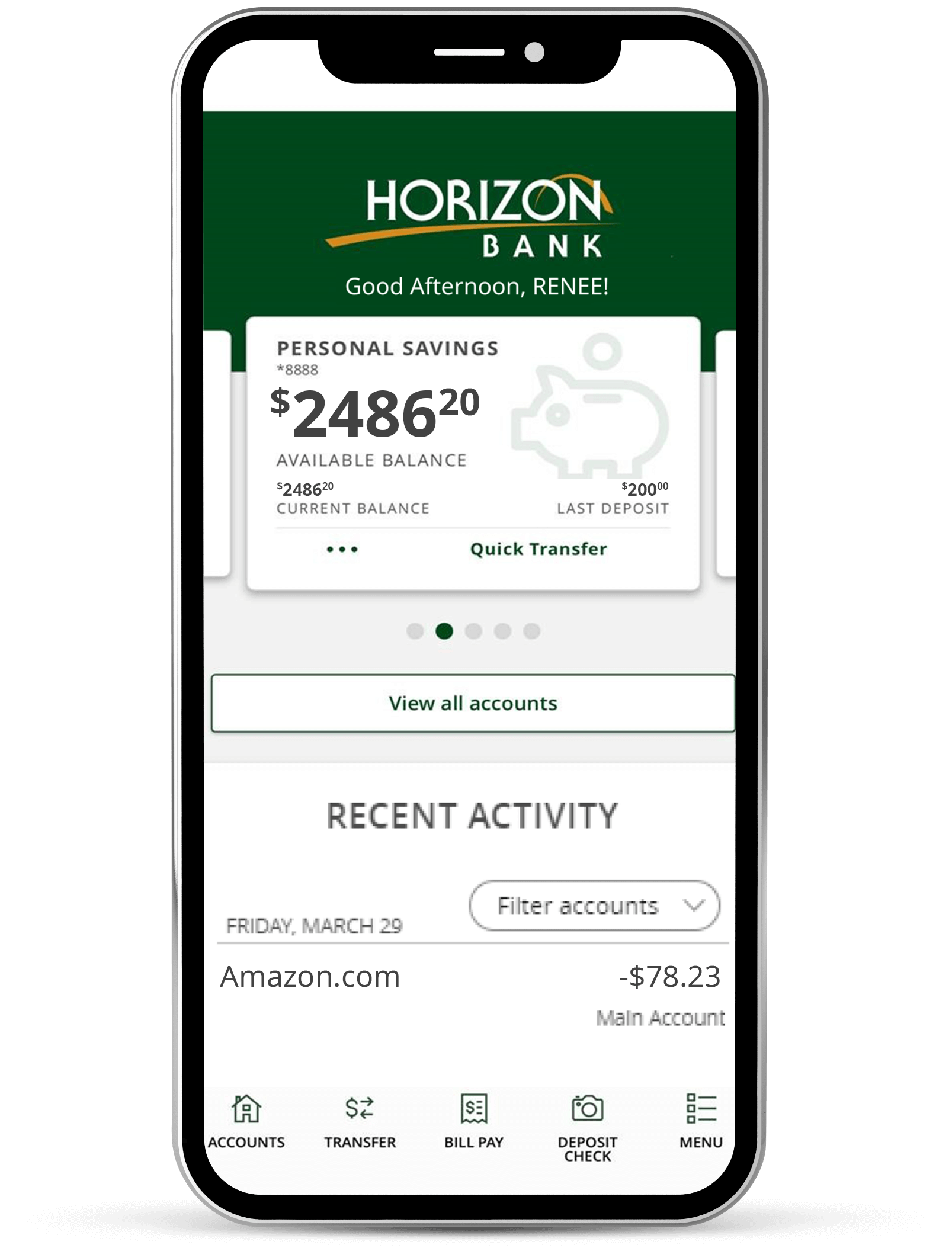

The good news here is that you can use Horizon’s CreditAdvisor tool to access to real-time scores and reports throughout the year. You can also request one free copy of your credit report each week, from each of the three major consumer reporting companies – Equifax, Experian, and TransUnion. You can call 1-877-322-8228 or visit AnnualCreditReport.com to request the reports.

Ready to enroll? Click here. Need to learn more about CreditAdvisor first? Click here to learn more.

By: Jean Chatzky

With reporting by: Casandra Andrews