4 Easy Ways to Save Money

Following the economic challenges brought on by the pandemic, Americans are more focused on saving money than ever before. Unfortunately, reports suggest that 27% of Americans have less than $1,000 saved, and 12% have no money saved. Although saving is increasingly crucial, it has been difficult for many reasons, including inflation and job stagnation.

Fortunately, it is possible to save money, even in challenging economic times. The first step is to evaluate your financial goals and resources. Determine how much you want or need to save and how much you can realistically save in a specified amount of time. Once you understand your finances, you can use these four tips to help you reach your savings goals.

Don't Miss Out on Savings with These Proven Tips

- Enroll your card in Easy Save. Easy Save is a convenient way to save money with every purchase. When you enroll your card in Easy Save, we round each purchase to the nearest dollar amount. Then, we transfer the change from your checking account to your savings account. You’ll automatically save $0.01 to $0.99 for each purchase made with an Easy Save card, which can add up to hundreds of dollars yearly!

- Set up a certificate of deposit. Certificates of deposit are high-yield savings accounts. You deposit a sum and let it sit for the time you choose – that’s it! Over the length of the account, your money accrues high interest, giving you better returns. These savings accounts are ideal for planned expenses like weddings, graduation, or college.

- Automate savings from your income. If you’re paid through direct deposit, allocate a specific amount to your savings account monthly. Automating funds directly to your savings account can help you resist the urge to use or spend it. The standard recommendation is to save 20% of your annual income.

- Delete unused subscriptions. Subscriptions to services you don’t use could cost you hundreds of dollars annually! Spending just 10 minutes finding and canceling unused subscriptions can save you a lot.

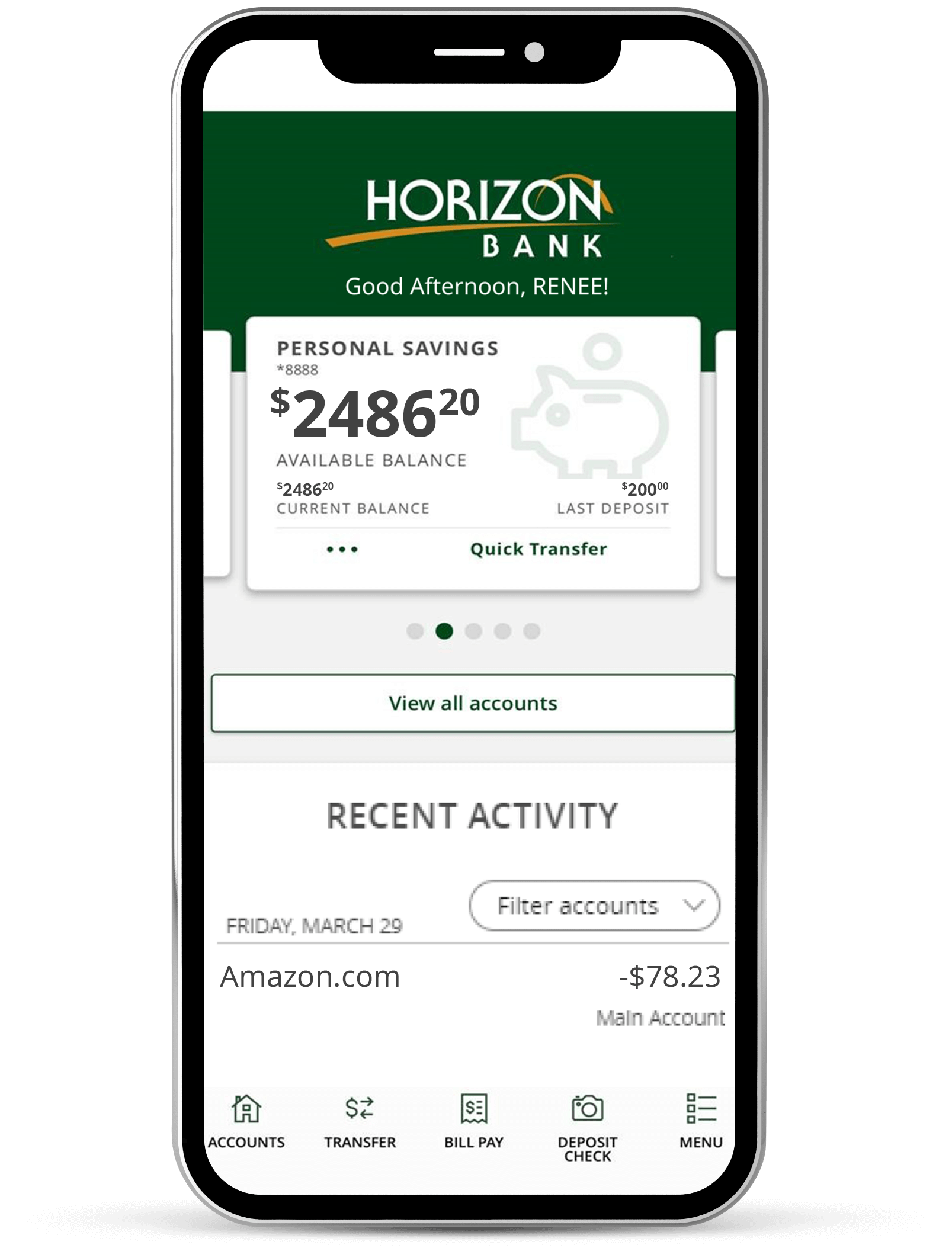

Saving money is crucial. It gives you a stronger financial future and helps you prepare for emergencies. If you need help meeting your financial or savings goals, contact an expert financial advisor at Horizon Bank.