Know Your Risk: Protect Your Money with FDIC Insurance

.png?sfvrsn=b0b15709_1)

You work hard to earn the money you need for a happy and fulfilling life. So when you deposit that money, you deserve the security and knowledge that your money is protected. Deposit coverage insurance is one crucial way to protect your hard-earned finances.

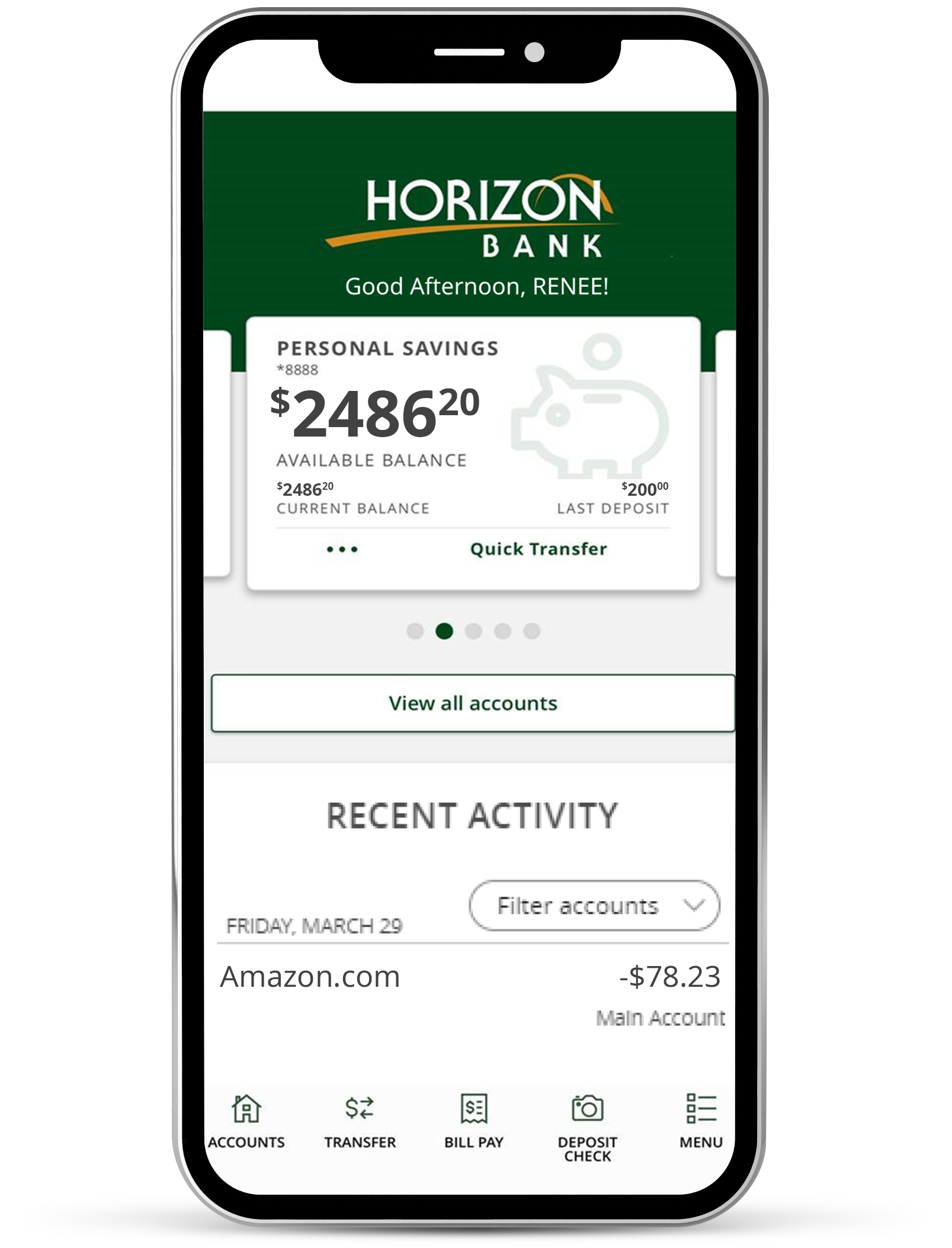

And at Horizon Bank, we’re proud to offer deposit insurance as an FDIC bank.

Proven Protection for Your Money and Future

The Federal Deposit Insurance Corporation (FDIC) is a national government agency that provides insurance on U.S. citizens’ financial deposits. Only banks that meet the corporation’s highest standards become recognized members of the FDIC. When a bank is an FDIC member, bank customers’ deposits into certain banking accounts are insured for up to $250,000. That means that if something were to happen to the bank, your finances would be covered up to that amount. The following account types qualify for this insurance:

- Checking accounts

- Savings accounts

- Money market deposit accounts

- Certificates of deposit

Additionally, FDIC deposit coverage extends to business accounts ! Give your business added protection by banking with Horizon. Deposits made to accounts associated

with your business, corporation, non-profit, or unincorporated entity are added up and covered up to $250,000.

This coverage is separate from any personal accounts you have at Horizon.

Horizon Bank has proudly served our Midwest communities for more than 150 years. We understand the importance of deposit coverage that gives you peace of mind, financial security, and more. That’s why we are a proud member of the FDIC. Contact a Horizon Bank advisor today to discuss opening a personal or business account – and know your deposits will be insured.

Call us Contact us Learn more about our personal checking accounts